Cracking the Code: Ralph Barsi’s Strategy Slide for GTM Sales in Early-Stage B2B SaaS

- Jackson Lieu

- Sep 5, 2024

- 7 min read

Updated: Sep 22, 2024

Times are tough.

Layoffs are still happening. People are losing jobs, houses, and hell; even loved ones.

Whether it's life or a breakup, one of the worst things anyone can do is take on a "promising" role yet it has Linkin's Park theme song "In The End" written all over it.

But what if?

What if there's a way to prevent this and say no before it's too late?

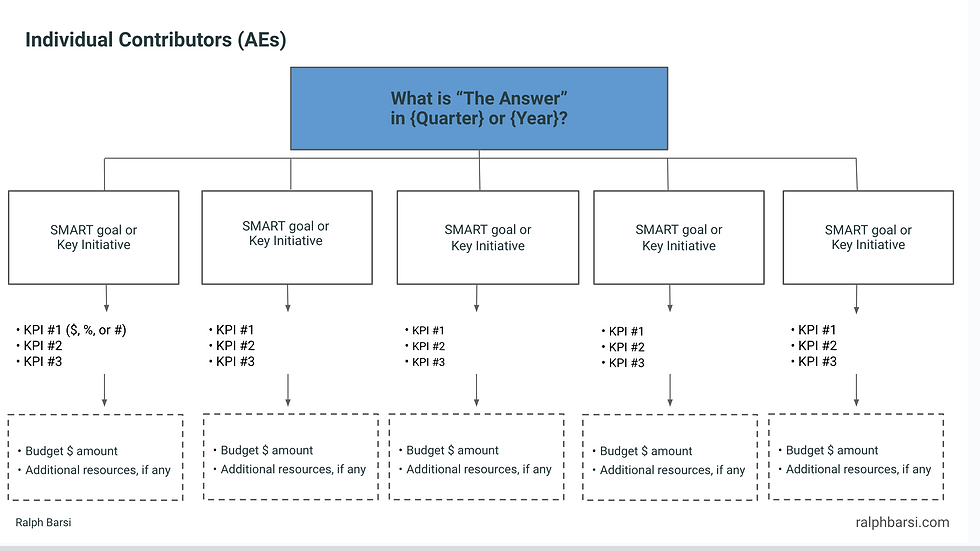

Without further ado, I present to you The Strategy Slide, by the one and only; Ralph Barsi.

Heavily influenced by The Pyramid Principle by Barbara Minto, it's an Answer First thinking approach.

The strategy slide begins with the end in mind.

This is known as The Answer and The Answer starts at the very top.

What's the end goal? What are you trying to achieve; and by when?

Everything you do, should either reach or get you one step closer to The Answer.

This is also known as "The What".

Key Initiatives

Next come Key Initiatives.

Key Initiatives are the actionable steps that will bring the company or project closer to The Answer.

They are the pillars supporting your strategy.

Prioritization: Which actions hold the most weight? Is it sales? Is it revenue? Determine the 2-3 initiatives that will have the greatest impact on achieving the goal.

Ownership: Every initiative must have clear ownership. Who will be responsible for driving each initiative forward and why must it be them? Assigning accountability is crucial to ensure follow-through.

Milestones: Break each initiative into smaller, measurable steps. What key milestones will show progress toward The Answer? This can be achieving X revenue by Z quarter, etc.

This is known as "The How".

KPIs and Metrics:

After defining Key Initiatives, it’s crucial to measure progress.

This is where KPIs (Key Performance Indicators) and Metrics come in.

Measuring Success: KPIs provide a clear, quantifiable way to track whether or not you’re moving closer to The Answer. Common metrics include revenue targets, growth rates, customer acquisition costs, or churn rates.

e.g. X amount of deals created per month, percentage of deals moving to next stages, dollar amount of deals closed/won

Data-Driven Decisions: By consistently monitoring KPIs, you can identify what's working, what's lagging, and where adjustments need to be made.

e.g. dial to connect rate, meetings held vs meetings converted, Tier B Deal is now a Tier A deal due to Executive Sponsorship.

Remember, as the saying goes, “numbers don’t lie.”

Each figure represents a signal for improvement or success.

Resources

Last but not least comes resources.

Resources: What tools, budget, or team members are needed to accomplish each initiative?

What's needed from "the company" in order to support this cause?

Should you bring in an outside inside sales team?

Should you bring on a Clay Master?

What is it?

This is often investments, time, or energy allocated from others provided BY THE COMPANY.

"It took me a good 2-3 weeks truly understand The Strategy Slide. Once I did, I knew hitting 500K in ARR was no where near possible."

graduation 2018

Context

For those who don't know, I joined Swif.ai earlier this year in February with a promise to become rich.

Less than 10 people and "backed" by Y-Combinator, Swif was on a mission to combine technology (SaaS) and device operations (onboard/offboard) employees along with streamlining device security for compliance via MDM and/or (mobile device management).

My dad had just passed, my older sibling is sick and my little brother is the only one back at home holding it down.

My mom is in pain, and as an Asian American and next runner-up as the eldest, it's my job and duty to pick up the baton that my dad had dropped.

All I knew was I HAD to go all in.

No Risk, No Reward; right..?

As you can see, my base was 42K (previously offered 38), big boy title, and big boy OTE with 50,000+ shares and no health benefits.

Break this down into 40 hrs a week it's $20/hr, fixed.

Factor in 70-80 hours a week..?

That'll put you at $11.55.

RED FLAGS

We see it all the time. Reps are out here getting exploited and by the time they find out, it's often too late.

This is more times than not offered with companies, agencies, or firms with:

Typical Offering(s):

Big Boy Title

Big Boy OTE

Big Boy Promises

Typical Current Condition(s)

Little to no runway

Less than 10 employees

No benefits (health, reimbursements, etc.)

Tie this into a very, very, very low base, there's your red flag.

It's okay to take a pay "cut", but if the cut is less than one can live off of; you best watch out.

e.g.

70-80K+ base with no health insurance for AE's is acceptable,

anything else below is not

60-70K+ base with no health insurance for SDRs is acceptable,

anything else that is not

So, what does 70-80 hrs a week look like?

Let me show you.

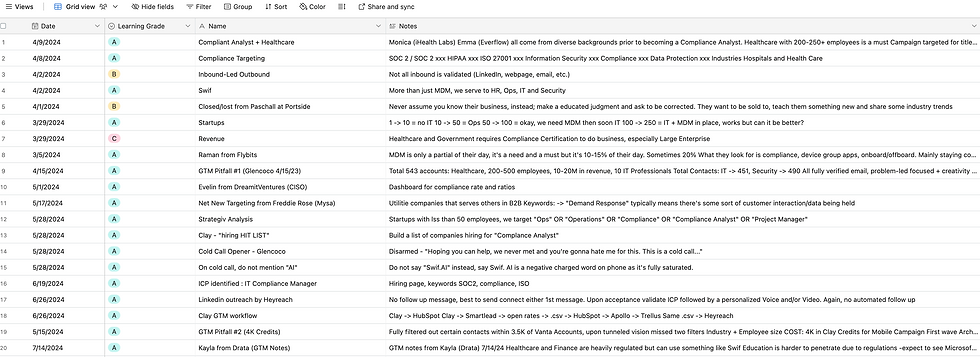

TASKS

ALL THINGS documented, from the gecko.

STRATEGIC ANALYSIS - current client sold base

INDUSTRY VERTICAL(s)

SUB VERTICAL(s)

BY THE NUMBER

BY THE SERIES

BY THE FIND

ICP SNIPED 🎯

5 Year Territory Attack Plan, Road to $40M in ARR

After running our strategic deep analysis on our current customer sold base, we've identified a total 179,961 of targeted accounts across SMB, Mid-Market, and Enterprise.

This includes Healthtech, SaaS, and Fintech all from Crunchbase.

PIVOTS AND LEARNING CURVES

After booking meetings with countless IT, Security, and InfoSec teams across all shapes and sizes, it's clear that our main targets are as follows...

🎯 Attributes:

╰┈➤ focusing on early-stage SaaS companies with employees ranging between 49-99 seeking compliance frameworks, has big logos but no SOC2, no internal IT teams and/or InfoSec teams.

"I gave it my all, I really did. In the end, it didn't even matter".

7 Mid Market Deals, all lost due to Maturity.

I penetrated one of my biggest outbound mid-market deals to date.

With 30% commission, you know it's going to be fat.

Metrics, Pain, and Impact' are all captured.

Director of IT, Head of InfoSec, Sr., and Jr. System Admin, are all on the call.

Upon piloting?

Done.

Why?

Maturity.

Too Fast, Too Soon; Jax.

Feedback from closed/lost accounts.

Existing integrations do not function as expected

MDM package management is incomplete

Compliance automation is not fully baked

I picked up the Strategy Slide in late July.

This combined with the most recent mid-market loss (mid-August) due to Maturity, a deal I'd been working on for two months; I knew it was over.

All that work toward the shiny OTE and the promise to one day become a VP of Sales, is gone.

POSITIVE(s)

Despite all the losses, we too; had big wins.

I helped grow Swif by 200%, flipped it upside down from operating underwater, and led to the acceptance to Pegasus Angelo Accelerator with 100K in additional funding.

Pegasus has less than a 1% (.08) acceptance rate.

For the first time in company history, surpassed 100K in ARR with the largest logos to date including both TrustRadius and Patreon.

Thanks to the Strategy Slide, I now know how Revenue Leaders think.

I have an average 30%+ close ratio and I move in stages.

I now have the ability to tier/score/scope a deal and SEE if it's a real deal or not AND I achieved Clay Mastery.

As much as I'd love to share, we'll save this for another post.

So the question remains, will I ever join another startup again?

The answer is hell yeah, you bet I would.

Just as long as the offer and conditions are right.

"Talent without the work is nothing" -CR7

KEY TAKEAWAYS:

The Strategy Slide represents the strategy itself.

Strategy = End in mind, aka "The Answer."

Tactics = How you're going to achieve the goal.

Think of it like winning the Super Bowl:

the strategy outlines why and what, while the tactics are the how.

RED FLAGS RECAP:

Big Titles, Big OTE, Low Base:

Promising high OTE with a low base salary is a warning sign. Even more, if it's a 1099 role with no health insurance.

For Account Executives, anything below $70-80K is a red flag, and for SDRs, it should be at least $60-70K.

note: these base pays are typically higher because you'd have to cover your own health insurance and tax at EoY

If you're a fulltime employee (FTE) then that's a different story.

Inconsistent Payroll:

If payroll is unreliable, it signals deeper financial instability.

No Customers, No Runway:

Lack of customers and a weak runway suggests the company is at risk, with no sustainable growth in sight.

Taking a Pay Cut:

It's acceptable to take a pay cut only if the base salary comfortably covers your basic needs without causing personal financial stress.

ENDING STATEMENT:

This journey taught me to always weigh the strategy and the numbers. Numbers don’t lie—they reveal whether a company is positioned for success or stuck in a survival mode.

When evaluating opportunities, don’t just listen to the vision; look for concrete metrics. It’s those percentages and numbers that tell the real story.

The Strategy Slide wasn’t just a plan for the business; it’s a guide for understanding how to assess opportunities and the people behind them.

Choose wisely, and ensure the foundation you’re building on is solid.

SAMPLE STRATEGY SLIDE MADE BY RALPH BARSI

DOWNLOAD TEMPLATE :

Dear Ralph,

Thank you.

Thank you for always being a father figure to me from day one.

Ever since we've met (Tenbound), you never looked the other way.

You pulled me out dark back in 2021.

You pulled me out of the dark when I was at Dick's Sporting Goods.

and you pulled me out of the dark again with the Strategy Slide.

I can never thank you enough.

Because of you, I'm now more of a High Caliber Sales Professional than I have ever been.

Thank you!

Full sincere,

Jax Lieu

RESOURCE(s)

Connect with Ralph Barsi on LinkedIn

Visit www.ralphbarsi.com

SPOTIFY LINK: SELL LIKE A LEADER

SDR-TV INTERVIEW:

Comments